mikaylamauger9

About mikaylamauger9

Understanding Gold IRA Kits: A Comprehensive Information

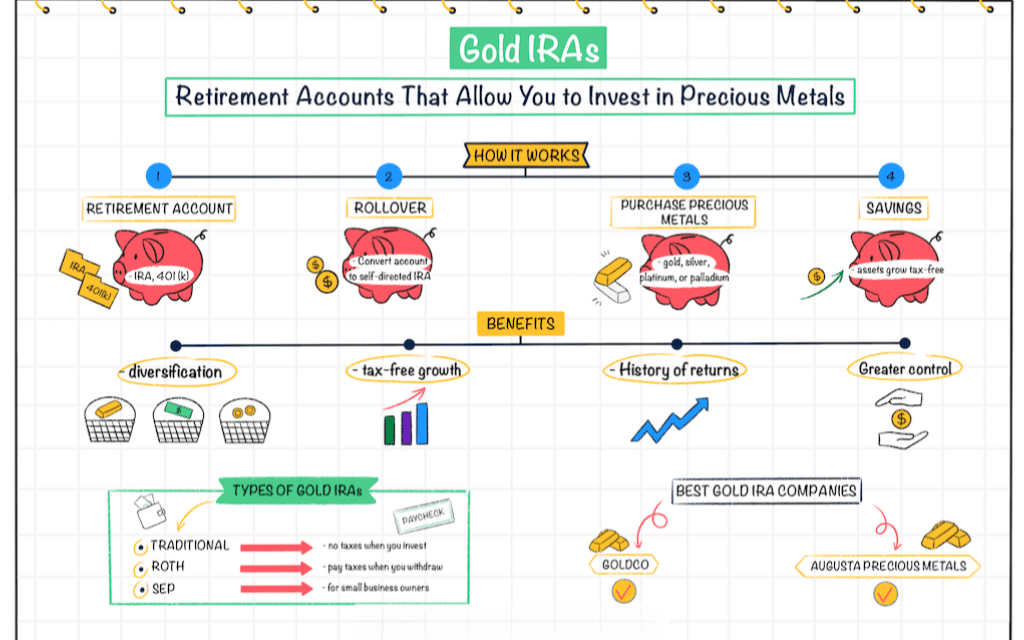

Investing in gold has long been considered a safe haven for wealth preservation, especially throughout times of financial uncertainty. As extra individuals search to diversify their retirement portfolios, Gold Particular person Retirement Accounts (IRAs) have gained popularity. A Gold IRA kit is a vital software for anybody trying to put money into gold for retirement. This report supplies an in depth overview of Gold IRA kits, their components, benefits, and issues for potential traders.

What’s a Gold IRA?

A Gold IRA is a kind of self-directed Particular person Retirement Account that enables buyers to hold physical gold and other valuable metals as a part of their retirement financial savings. In contrast to conventional IRAs, which typically hold stocks, bonds, and mutual funds, Gold IRAs present the chance to put money into tangible property. This may be particularly interesting throughout times of inflation or financial downturns, as gold typically retains its worth better than paper assets.

The Elements of a Gold IRA Kit

A Gold IRA kit sometimes contains several essential parts that information buyers through the process of establishing and managing their Gold IRA. Here are the key parts often found in a Gold IRA kit:

- Informational Brochures: These brochures provide an overview of Gold IRAs, explaining how they work, the benefits of investing in gold, and the potential dangers involved. They often include data on market trends and historical performance of gold as an investment.

- Account Setup Directions: This part outlines the steps essential to ascertain a Gold IRA. It includes info on selecting a custodian, filling out the necessary paperwork, and funding the account.

- Investment Options: A Gold IRA kit will sometimes current various investment choices obtainable within the account. This may increasingly include different types of gold bullion, coins, and other treasured metals which can be IRS-accepted for inclusion in a Gold IRA.

- Storage Info: Since Gold IRAs require the bodily storage of gold, the kit will present details on find out how to store the precious metals safely. This will embody information on authorized depositories that offer safe storage options.

- Tax Information: Understanding the tax implications of a Gold IRA is crucial. The package will usually embrace details on how contributions, distributions, and the sale of gold within an IRA are taxed, including the advantages of tax-deferred development.

- Frequently Asked Questions (FAQs): A section addressing frequent queries about Gold IRAs, similar to eligibility necessities, contribution limits, and the method for rolling over current retirement accounts right into a Gold IRA.

Advantages of a Gold IRA

Investing in a Gold IRA gives a number of advantages that can improve an individual’s retirement portfolio:

- Inflation Hedge: Gold is often considered as a hedge in opposition to inflation. In the event you loved this post and you would love to receive details regarding best Companies for precious metals iras please visit the web page. As the price of living rises, gold prices tend to increase, helping to preserve buying energy.

- Diversification: Including gold in a retirement portfolio can present diversification, lowering total threat. Gold usually moves independently of stocks and bonds, providing a buffer during market volatility.

- Tangible Asset: In contrast to stocks and bonds, gold is a physical asset that holds intrinsic worth. This will provide peace of mind for traders who prefer to hold tangible investments.

- Tax Advantages: Gold IRAs provide tax-deferred development, meaning traders do not pay taxes on gains until they withdraw funds during retirement. This will lead to significant tax savings over time.

- Safety Towards Economic Uncertainty: Throughout economic downturns or geopolitical instability, gold has historically maintained its value, making it a reliable funding during turbulent occasions.

Considerations When Investing in a Gold IRA

While Gold IRAs supply many advantages, there are also issues that potential traders ought to keep in thoughts:

- Custodial Fees: Gold IRAs require a custodian to manage the account, and custodial fees can differ. It’s essential to know the charge construction and how it could influence overall returns.

- Storage Costs: Physical gold should be stored in an authorized facility, which regularly incurs extra costs. Traders should consider these expenses when calculating potential returns.

- Market Volatility: While gold is commonly seen as a protected investment, its price could be unstable in the short time period. Traders should be prepared for fluctuations in gold prices and consider a long-term funding strategy.

- IRS Rules: The IRS has particular rules relating to what forms of gold and valuable metals can be included in a Gold IRA. It is essential to make sure that investments comply with these regulations to keep away from penalties.

- Restricted Development Potential: Unlike stocks, gold does not generate revenue or dividends. Traders ought to consider this when evaluating their total funding technique.

How to decide on a Gold IRA Kit

When deciding on a Gold IRA kit, buyers should consider the next components:

- Reputation of the Supplier: Analysis the company offering the Gold IRA kit. Look for opinions, scores, and any complaints to make sure they’ve a stable fame in the trade.

- Transparency: An excellent Gold IRA kit ought to present clear information about fees, funding options, and the account setup process. Transparency is crucial for constructing trust.

- Buyer Assist: Consider the level of customer support supplied. A educated representative can assist with questions and information buyers through the method.

- Educational Sources: Look for a kit that includes academic materials to assist traders understand the intricacies of Gold IRAs and valuable steel investments.

- Flexibility: Some Gold IRA kits supply extra flexibility in terms of funding choices and account administration. Choose one which aligns with your investment objectives and preferences.

Conclusion

A Gold IRA kit may be an invaluable useful resource for people looking to put money into gold as a part of their retirement technique. By understanding the parts, advantages, and considerations related to Gold IRAs, buyers can make informed decisions that align with their monetary goals. As with all investment, thorough research and cautious planning are essential to maximize the potential of a Gold IRA and secure a stable monetary future.

No listing found.