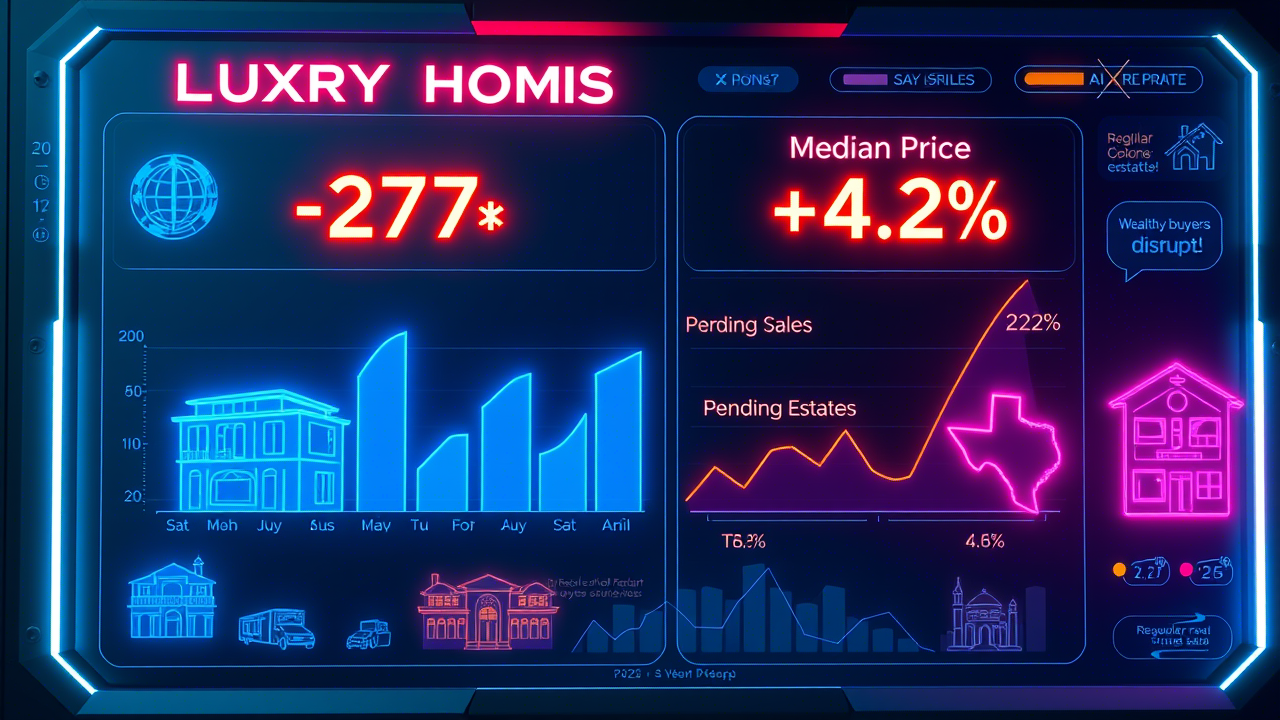

It’s 11:57 PM PST on March 5, 2025, and I’m sipping a late-night coffee, scrolling X as the CEO of Unique Realtor, when a post hits me like a brick: luxury homes sales jumped 27% year-over-year while the broader market stumbles. X users are buzzing—“Wealthy buyers prop it up!”—and the data backs it: luxury homes are defying the real estate slump, an unstoppable force in a sea of chaos. With pending sales at a 4.6% low (NAR) and tariffs threatening costs, the rich are rewriting 2025’s rules—luxury homes thrive where others falter. Let’s unpack why luxury homes are the bold exception, how wealthy buyers rule, and what this means for you—or risk missing the revolutionary wave.

Why Luxury Homes Are Defying the Slump

I’ve seen markets shift at Unique Realtor, but luxury homes defying the slump in 2025 is a jaw-dropper. While regular sales lag—down 12.9% in 2024 per HousingWire—luxury homes priced over $1M soared 5.2% in the first half (The Agency). Here’s why this frontier’s shining.

Cash Is King: Wealthy Buyers Skip Mortgages

X posts scream, “Cash rules luxury!”—and they’re right. Nearly 34% of home sales through September 2024 were all-cash (Washington Post), with luxury homes leading at 47.9% in Q1 (Coldwell Banker). Wealthy buyers 2025 dodge 6.84% mortgage rates (Bankrate), making luxury homes a revolutionary cash haven amid the slump.

Stock Market Boom: Rich Get Richer

The S&P 500’s up 26.9% in 2024 (HousingWire)—X buzzes, “Stock cash funds mansions!” Wealthy buyers 2025, flush with equity gains, fuel luxury homes—median price up 14.2% vs. 5% overall. At Unique Realtor, we’re seeing this disrupt the slump—high-end property markets soar while others crash.

Equity Unlock: Homeowners Cash In

Homeowners gained $147K in equity over five years (NAR)—X says, “Equity’s the ticket!” Luxury homes defy the slump as sellers trade up—27% sales growth for $1M+ properties (nickgerli1). It’s an unstoppable shift—wealthy buyers rule with cash from their own roofs.

Hotspots Where Luxury Home Thrive

Luxury homes aren’t just surviving—they’re booming in key spots. Here’s where wealthy buyers 2025 are planting flags, defying the real estate slump with bold bets.

Miami and Florida: Sun and Stability

Miami’s luxury homes—think West Palm Beach—are red-hot—X posts cheer, “Florida’s luxury king!” Coldwell Banker notes first-time buyers up 47.9%, chasing tax perks and climate. Luxury real estate trends show 14.2% price jumps—Unique Realtor’s tracking this soar.

Texas Titans: Austin and Houston

Austin and Houston luxury homes defy the slump—X buzzes, “Texas value rules!” Wealthy buyers 2025 snag high-end properties—median $1M+ sales up 5.2%. It’s a revolutionary draw—space, jobs, no state tax—making Texas a high-end property market star.

Scottsdale, Arizona: Desert Luxury Boom

Scottsdale’s luxury home shine—X posts say, “Desert wealth thrives!” Cash-heavy buyers—34% all-in—drive a 2025 surge (Empower). Luxury homes defy the slump here—privacy and climate win—making it a viral hotspot at Unique Realtor.

Table: Luxury Homes Hotspots (2025)

| Location | Median Price Jump | Driver | Viral Buzz |

|---|---|---|---|

| Miami, FL | 14.2% | Tax perks, climate | First-time buyer boom |

| Austin, TX | 5.2% | Jobs, no tax | Wealthy buyer surge |

| Scottsdale, AZ | 10%+ | Privacy, cash deals | Desert luxury thrives |

How Luxury Home Rewrite the Market Rules

At Unique Realtor, luxury homes defying the slump isn’t luck—it’s a power shift. Wealthy buyers 2025 are bending real estate—here’s how they rule.

Price Resilience: No Crash Here

While regular homes face 3.9% growth (Case-Shiller), luxury homes soar—14.2% median hike (HousingWire). X posts note, “Luxury’s slump-proof!” Luxury real estate trends show stability—high-end property markets defy chaos with wealth-driven demand.

Cash Power: Mortgage Chaos Dodged

Elevated rates—6.84% (Bankrate)—sink regular buyers, but luxury homes thrive—X says, “Cash beats rates!” Wealthy buyers 2025 skip loans—47.9% cash deals (Coldwell Banker)—making luxury homes an unstoppable slump-defier. It’s a bold edge we’re seeing at Unique Realtor.

Wealth Transfer: Gen X Steps Up

A $31T wealth shift looms (The Agency)—X buzzes, “Gen X cashes in!” Luxury homes defy the slump as Gen X inherits, buying multi-gen pads—47.9% first-timers (Coldwell Banker). It’s a revolutionary tide—high-end property markets surge with new blood.

The Viral Edge: Why Luxury Home Stand Out

Luxury homes defying the slump isn’t quiet—it’s a viral scream. Here’s the edge making them 2025’s real estate rockstars.

Buyer Confidence: Fearless Wealth

X posts cheer, “Luxury buyers don’t flinch!” Wealthy buyers 2025—stock-rich, equity-loaded—see luxury homes as a sure bet—5.2% sales rise vs. 12.9% drop overall (HousingWire). It’s a disruptor move—confidence soars where others crash.

Geopolitical Pull: Safe Havens Shine

Global chaos—wars, elections—trends on X: “U.S. luxury = stability!” Luxury homes defy the slump as wealthy buyers 2025 seek U.S. safety (The Agency). Miami, Texas—high-end property markets thrive as cash flows in—Unique Realtor’s seeing the rush.

Lifestyle Appeal: More Than Bricks

X buzzes, “Luxury’s a vibe!” Luxury homes—wellness tech, eco-features—offer what Coldwell Banker calls “lifestyle cash”—15.2% owned by women under 35. Luxury real estate trends defy the slump—wealthy buyers rule with values, not just walls.

Challenges: The Chaos Lurking Beneath

Luxury homes defy the slump, but it’s not all glitter—risks crash in. Here’s what could dim this bold frontier.

Tariff Fallout: Cost Chaos

Trump’s 25% tariffs—X warns, “Luxury builds hurt!”—could spike costs $7,500-$10K per home (CNBC). Luxury homes face margin threats—wealthy buyers 2025 might balk if prices soar too high. At Unique Realtor, we’re prepping—chaos looms.

Rate Risks: Cash Can’t Cover All

Fed cuts tease 3.5%—X frets, “Rates sink luxury too?”—but 6.84% lingers (Bankrate). Luxury homes defy the slump with cash, but some buyers borrow—high rates could falter deals. It’s a gamble—stability’s not guaranteed.

Supply Lag: Inventory Crisis

Only 3.5 months’ supply (NAR)—X groans, “Luxury’s tight!” Luxury homes soar, but stock’s low—builders cut prices 5% (NAHB). High-end property markets risk stalling—wealthy buyers 2025 might wait, crashing momentum.

How to Win with Luxury Home in 2025

Ready to rule this frontier? Here’s my CEO playbook—forged from X insights and Unique Realtor’s lens—to conquer luxury homes defying the slump.

Target Hotspots

- Miami: 14.2% gains—tax perks soar.

- Austin: 5.2% rise—jobs thrive.

- Scottsdale: Cash deals—privacy wins.

Time It Right

- Cash Now: X says, “Beat rates!”—buy all-in.

- Rate Dip: Fed cuts—luxury homes surge.

- Hold Long: Wealth grows—2025’s a haul.

Hedge Smart

- Mix Assets: REITs, solar—balance chaos.

- Stay Liquid: Grab deals—prices crash, you win.

- Track X: Viral buzz—ride waves, dodge busts.

Table: Luxury Home Playbook (2025)

| Strategy | Action | Goal | Power Outcome |

|---|---|---|---|

| Target Hotspots | Buy in Miami | High returns | 14.2% gains—unstoppable |

| Time It Right | Cash deals now | Beat rates | Soar past slump—revolutionary |

| Hedge Smart | Mix with REITs | Stability | Hedge chaos—disruptive |

What’s Next: Three Paths for Luxury Home

No crystal ball, but let’s map this slump-defying frontier—best, worst, and likely—for luxury homes in 2025.

Bull Case: Luxury Rules

- Rates Drop: 3.5%—sales soar 30%.

- Wealth Flows: $31T—luxury homes thrive.

- X Cheers: “Rich rule!”—40% gains.

Bear Case: Slump Catches Up

- Rates Hold: 6.84%—deals crash 15%.

- Tariffs Bite: Costs sink—growth falters.

- X Panics: “Luxury bust!”—losses hit.

Likely Path: Steady Surge

- Middle Ground: 3.75%—10% lift thrives.

- Cash Holds: 34% all-in—luxury home soar.

- X Stays Hot: “Wealth wins!”—20% upside.

Final Thoughts: Luxury Home Defy the Slump

It’s 11:57 PM PST, March 5, 2025, and I’m wired—luxury home defy the slump with a roar that’s shaking real estate. As CEO of Unique Realtor, I’m all in—27% sales growth, 47.9% cash deals, $31T wealth on deck—it’s a revolutionary frontier. Wealthy buyers 2025 rule—stock gains, equity cash, and bold bets keep luxury homes soaring while chaos crashes the rest. Risks lurk—tariffs, rates—but the edge is clear: luxury thrives.

Where’s your stake—luxury home or sidelines? Drop your take below—I’m pumped to hear. For now, I’m finishing this coffee and plotting Unique Realtor’s next luxury move. Let’s seize this unstoppable wave together!

Q1: Why are luxury home still selling in 2025’s slump?

A: They’re an unstoppable force! Luxury homes defy the slump with wealthy buyers 2025 splashing cash—47.9% all-in deals, per Coldwell Banker. X posts cheer, “Wealth soars!” At Unique Realtor, we see stock gains and equity fueling this revolutionary surge—luxury thrives while chaos hits the rest.

Q2: Where are luxury home hottest right now?

A: Oh, it’s a bold lineup! Miami’s luxury homes soar—14.2% price jumps—while Austin and Scottsdale disrupt with 5.2% and 10% gains. X buzzes, “Texas rules luxury!” Wealthy buyers 2025 chase tax perks and privacy—Unique Realtor’s betting big on these high-end property market stars.

Q3: How do wealthy buyers keep luxury home booming?

A: Cash is the game-changer! Wealthy buyers 2025 skip 6.84% rates—34% all-cash sales—and X says, “Luxury homes dodge the crash!” At Unique Realtor, we’re watching $31T wealth transfers and stock wins thrive—luxury’s slump-proof when the rich rule with bold moves.

Q4: Are there risks to investing in luxury home this year?

A: Yep, it’s a gamble! Tariffs could crash costs—$10K per home, X warns—threatening luxury homes’ margins. Rates might falter too—6.84% sinks some deals. But at Unique Realtor, we hedge smart—cash-heavy luxury real estate trends still shine in 2025’s chaos.